17 years helping South African businesses

choose better software

Mint

What Is Mint?

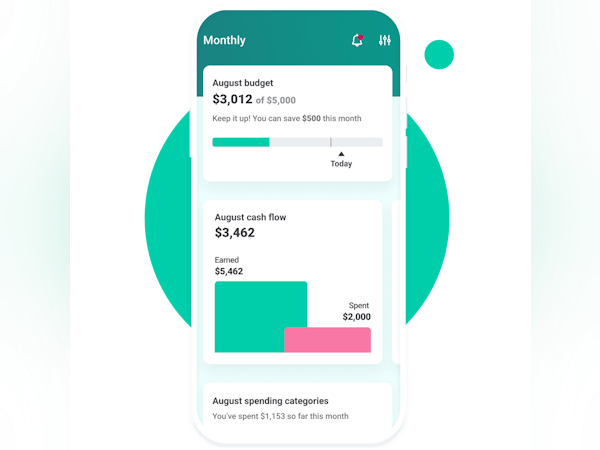

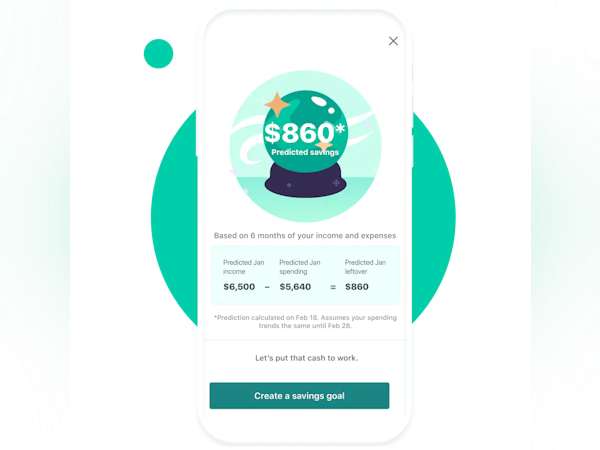

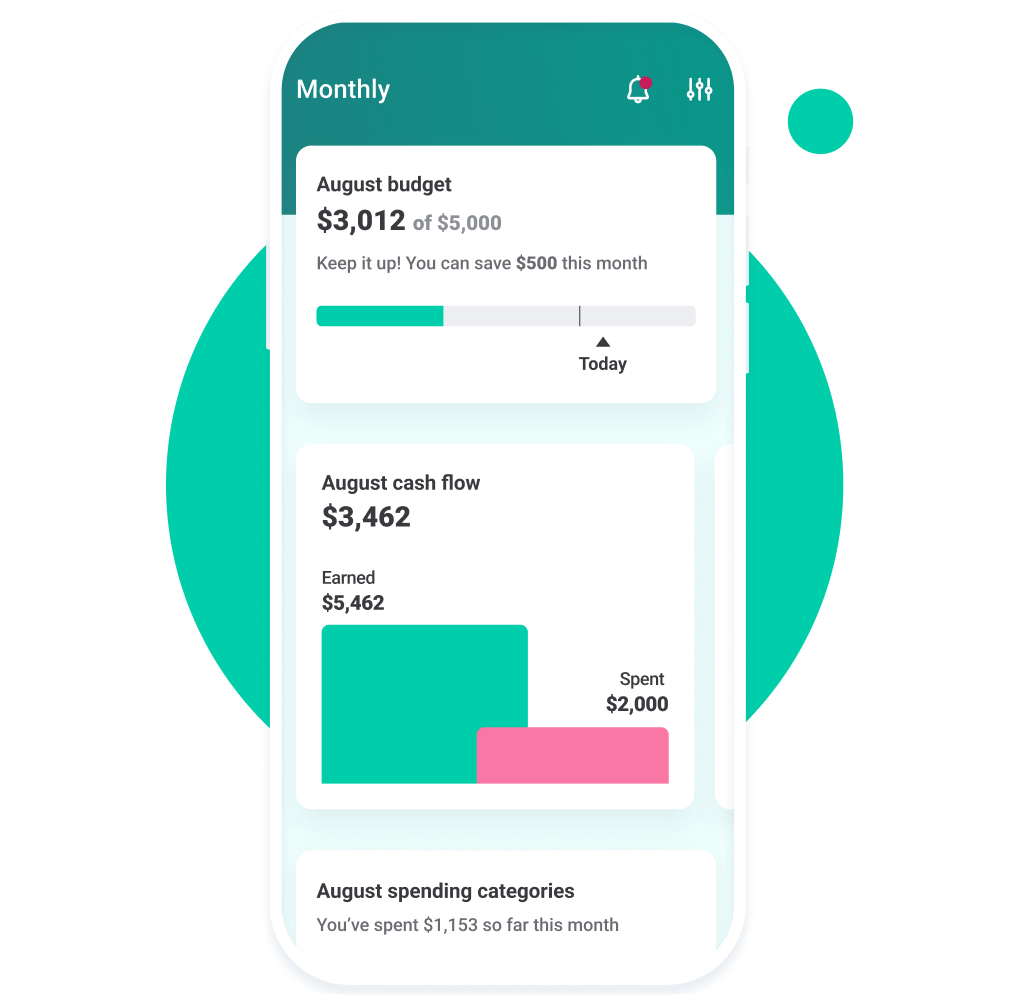

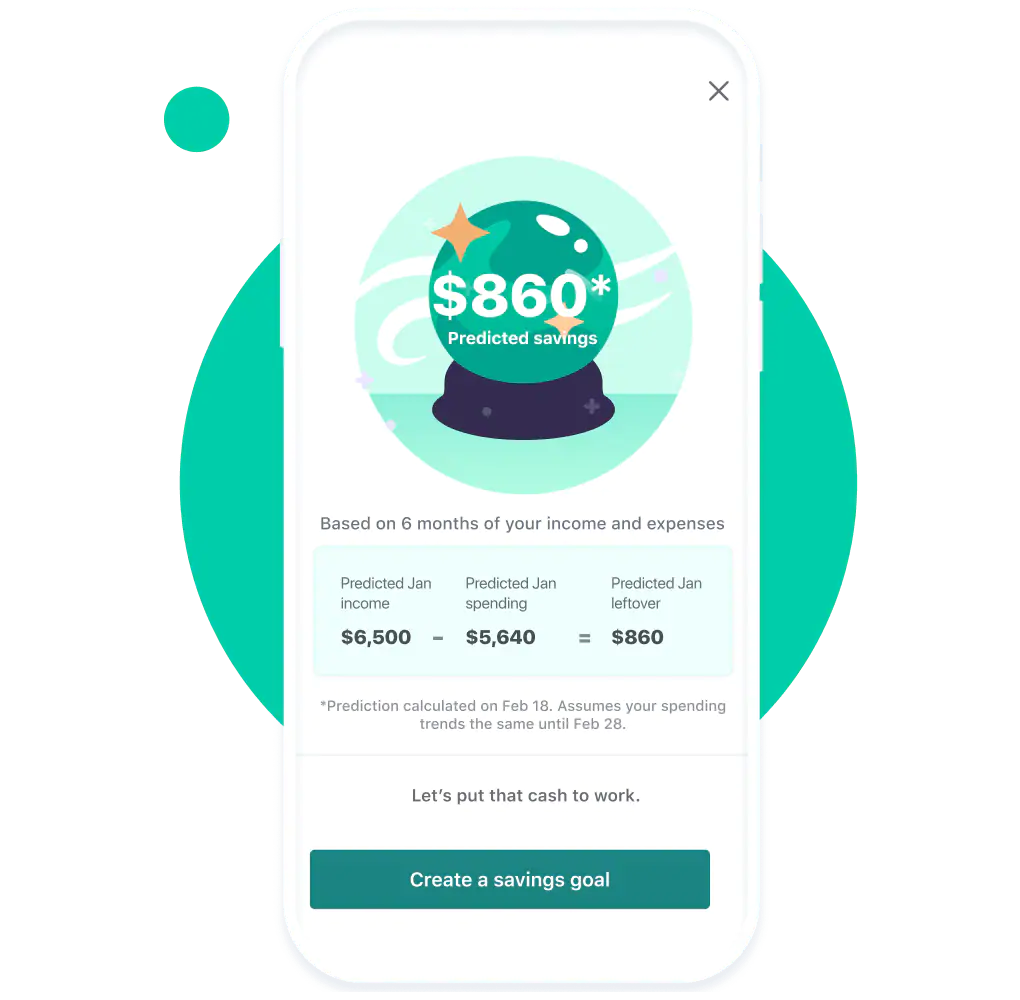

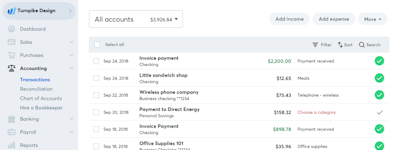

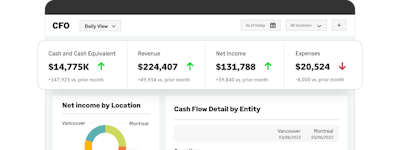

Mint is a free online money management tool that helps you budget, track spending, and monitor your credit score. Mint pulls all of your financial accounts into one place so you can finally get a complete picture of where your money is going.

Who Uses Mint?

Not provided by vendor

Not sure about Mint?

Compare with a popular alternative

Mint

Reviews of Mint

A very efficient personal finance management tool to track spendings, create budgets, and more

Comments: Mint is a popular and reputable personal finance management tool that is a great resource for us to understand better and manage our finances.

Pros:

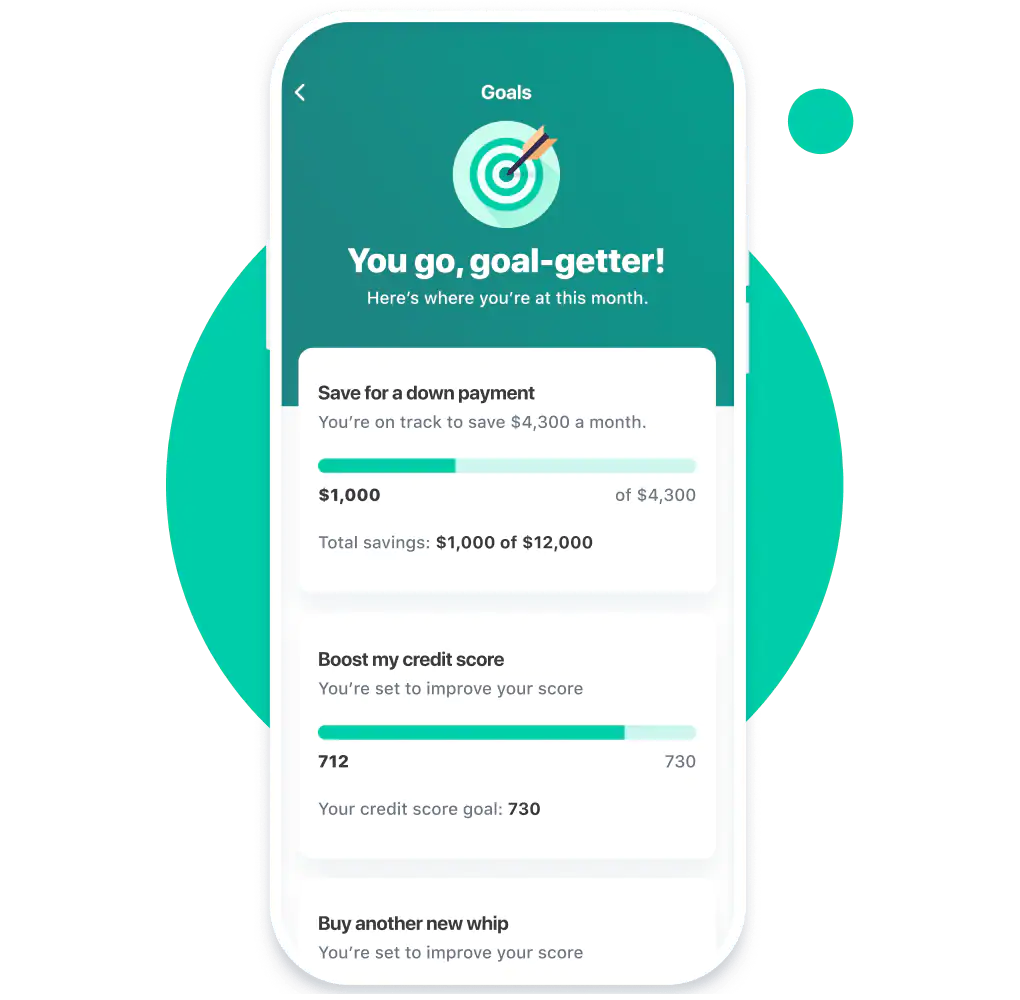

User-friendly interface: Mint has a clean and easy-to-use interface that makes navigating and understanding our financial information simple.Automatic account updates: Mint automatically updates our financial information, so we always have the most current information at our fingertips.Budgeting tools: Mint has various tools that help us better understand our spending habits and create a budget that works for us.Budget tracking: Mint allows us to connect our bank and credit card accounts to the platform, automatically categorizing transactions into different spending categories (e.g., groceries, entertainment, transportation). We can then set budget goals for each category and track our spending over time to see where they are over or under budget.Bill reminders: Mint reminds us when bills are due so that we can avoid late fees.Investment tracking: Mint allows us to track investments such as stocks, mutual funds, and other securities.Mobile app: Mint has a mobile app that allows us to access our financial information on the go.

Cons:

Limited investment tracking: Mint does not offer as much investment tracking as other personal finance management tools, but not to the extent that it becomes a huge downside.

The best money management tool

Comments: I use Mint to help meet my financial goals, such as saving for a home down payment. It helps me see areas where I could do better as well as areas where I am doing fine. It's simple, integrated on your phone, and best of all it's free.

Pros:

Mint is a fantastic and free tool for managing your money. It allows you to gather all of your financial accounts in one place so you can accurately track your net worth over time, as well as serve as an easy tool for budgeting and expense tracking.

Cons:

Mint does have some intelligent tracking of purchase categories, but it seems like it hits a point where it doesn't try very hard. I have to do quite a bit of manual recategorizing, even for regular purchases.

Decent for expense tracking, but that's about it

Comments: It helps with expense tracking and it does very well in that regard.

Pros:

It does a good job of automatically logging expenses and after implementing a few custom rules, it's pretty accurate with categorizing them properly.

Cons:

The budgeting aspect of mint does not match the reality of how people "really" budget. There will always be months of overspending and months of underspending... and everyone's "income" is a bit variable (monetary gifts, product returns, etc). Mint doesn't account for these very well and it does nothing for planning.

Alternatives Considered:

Great alternative to expensive accounting software

Comments: I am loving this software. I was hesitant at first after using another software for years, but I was pleasantly surprised and how much I love it and how easy it is to manage my finances.

Pros:

I was vert impressed with how easy this software is to set up and use. Very self explanatory. I love that they monitor your money and your spending and alert you when thigs don't seem right or when you go over budget.

Cons:

The automatic assignment of some accounts is inaccurate

Free

Comments: If you want a cheap, basic, easy and good software try out MINT.

Pros:

The best thing about mint is that it is FREE. I have used Quickbooks and Freshbooks and had many issues with them.

Cons:

I haven't found any issues so for using Mint. You can do basically most thing that you would pay for on mint and its free.

App tracks expenses and budgeting

Pros:

Easy to use app that links to all accounts easily to track expenses and budgeting. The results were not what I expected

Cons:

Nothing specific that I would like to highlight

Mint is my favorite place to keep track of my family's budget

Comments: Very positive. Used it for years with no plans on changing.

Pros:

My family has used Mint for years to keep track of our personal budget. The integrations that it has with my banks has been instrumental in helping my family manage our finances.

Cons:

At least for the personal finance aspect, it is heavily focused on monthly expenses which makes it slightly difficult to keep track of expenses that are not monthly such as insurances which are bi-annual or annual. They have improved their budget keeping to allow for rollovers which is how we keep track of those expenses that are not monthly but I still wish I could set an annual budget for those expenses

One of my favorite and best cloud application

Comments: This is one of my favorite and best cloud application that I have been using since 2012, it has all the features that you can expect from an online cloud based accounts management. As a developer and project manager myself I could not have expected anything more from the team. Support this team by applying for the offers that they present as an options to save.

Pros:

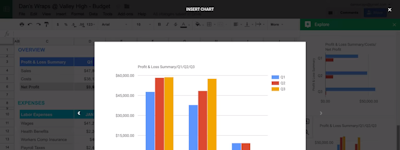

Very easy to understand nothing to download or install just setup your accounts online: credit cards accounts, bank accounts, investment accounts... Major US Institutions are integrated and also you have an option to enter manually any account or institution that are not supported. It pulls all the individual transactions from your institution in a secured transaction, simply categorized your transactions, add tags, notes and voila you have all the reports in real time. Drill down your report with pie or bar chart add specific filters: month, year or custom filter for specific category, account, merchant or tag. Export transactions to a CSV for further analysis or reporting with the power of spreadsheet. Setup your budget, goals for tracking and alerts. Best part it is Absolutely free!

Cons:

Currently it does not support multi-currency due to which if you have an overseas account and you would like to see your net worth you will have to convert those transaction manually and enter them. It only supports US institutions no support for overseas bank, institutions. No integration with Turbo Tax or any tax software for filing taxes online

Mint is Marvelous

Comments: Mint has really helped me develop a clear picture of my spending. I love the charts to show what categories I spent this month total vs last month or vs last year. I can easily adjust categories or add tags to items on my credit cards to properly organize them as far as medical vs home vs entertainment etc. I love to see my net worth at a glance. Mint is marvelous!

Pros:

I love everything about Mint. You can have all of your finances in one place to see what you spend and what you invest. Categories are memorized so all of your spending is organized. Super easy to develop and manage monthly budgets. All accounts are synced in real time.

Cons:

Of course one has to set up all their accounts to get started. Once that is done it is terrific. On rare occasion one of may accounts will mysteriously disappear. However, I just add it again and it reappears. A small annoyance, but nothing more.

Very strong financial app.

Comments: Excellent app that is easy to set-up and utilize on a daily basis.....Does a nice job synching all account.

Pros:

Mint is easy to use and does as advertised. Also a 100% FREE APP. Simple, but attractive user interface.

Cons:

Not very good at tracking investments accounts.

Mint Review

Comments: Great platform!

Pros:

Mint is a great finance software to help you keep track of your expenses and budgeting. It is for user friendly and the platform is very easy to use and organized. Also great it connects with Turbo Tax so I was able to track my tax return through Mint one year.

Cons:

There’s nothing I don’t like about Mint.

Take control of your finances with this one tool

Pros:

For a beginner looking forard to take control of your finances, be it personal or for your business, this is a great tool for simplifying the ins and out of all the transactions in some simple app. The ability to link all your banks accounts and track the expense if a powerful and helpful tool for me. The free credit history tool is valuable as well!

Cons:

With all the integrations with my banking app and other financial tools, i am often concerned the security of my data. A robust data privacy platform from Mint (intuit) will be reassuring for the users.

Mint an excellent choice for all your budgeting and financial planning needs

Comments: I have been a customer that has stood the test of time. After many attempts years ago to find the program that would work best for me, I was introduced to Mint and never went back.

Pros:

I love that I have had one piece of software that I have used for more than 10 years! I also appreciate that updates make it better each year! It has served my purposes in personal finance and in business which thrills me. Thankful for software that truly helps its customers rather than just seeking to take advantage of or use its clientele.

Cons:

Some features are frustrating. I would like to be able to adjust past budgets for instance and have everything updated to the present. Also, getting the categorization feature to be consistent as I always have to double-check most months. While this is a con I am super thankful for the items it get right!

Personal Finance Made Easy!

Comments: I started using Mint a few years ago after deciding I wanted to keep track of my personal finances. I initially started out writing out all my expenses on the iPhone notes app. When I downloaded Mint I couldn't believe how easy it was! I didn't have to manually write out my expenses anymore. Mint does everything for you and categorizes all the purchases you've made via your linked cards. I always recommend it to all my friends and family!

Pros:

There are so many things I love about this app! For one, the interface is very user-friendly. You just connect your debit and credit cards and then Mint categorizes and keeps track of your bills and expenses. I love that you don't have to do anything. Mint does it all for you so it's perfect for anyone new to personal finance. I like how Mint shows you your daily, weekly, and monthly spending in a graph and list form. It makes it really easy to visually see your spending habits. I also like how Mint suggests different credit cards for you and shows you how much you can save and perks for each card. Whenever I'm shopping for a new credit card it's really easy to just scroll through the credit card list on Mint and quickly scan for the one that offers the best sign up bonus and perks.

Cons:

Mint automatically categorizes your purchases so you can see how much you're spending in each category. For example, some of my main categories are clothing, shopping, gas & fuel, groceries, etc. Mint is pretty good at categorizing your purchases correctly but a few times a month Mint will wrongly categorize my purchases. Just last week a purchase that should have been "groceries" was actually categorized as "clothing". It's not a huge issue but it does make it necessary to manually scan through everything to make sure I'm getting accurate information on my spending habits.

All of my financial info in one space

Comments: Great experience, it takes the mystery out of my finances

Pros:

Being one of the first groups to do this, almost all financial accounts can be linked to mint. The tracking of each account is great, and it helps me see all spending and investing in one spot

Cons:

The mobile app does have stripped down features such as adding or editing accounts

All-in-One Financial Management

Pros:

Mint is great for managing accounts all in one place and being able to track expenses, income, goals, and budgets. Easy-to-understand visuals. It also generates interesting tidbits to help you gain insight on your spending and saving habits.

Cons:

I've had some trouble getting certain bills/financial institutions linked to Mint, it would also be nice to have an integration with Apple Card to pull that into the budgets instead of having to manually enter transactions, but that may be on Apple's end of things.

Favorite software of the year

Comments: Overall Mint is my favorite software of the year! I love how it's a powerful but also simple-to-use tool for managing my finance and giving me a peace of mind. Thanks Mint!

Pros:

I really love how Mint is so intuitive to navigate and offers everything I need for managing my personal finance. I could link it with my bank accounts easily, and it displays the amounts in all the various accounts nicely categorized and quickly refreshed. It shows my monthly spending with different categories, so I could painlessly track my spending and stay on budget.

Cons:

My only complaint is the categories of my spending are sometimes wrong, and it's a hassle to go back and change the categories so the data visualization tools such as the pie chart displays correct information. I wish there's an easy way for Mint to automatically categorize my spending better, perhaps learning from big data of various users?

Fantastic Financial Aggregator

Comments: I login to Mint daily to ensure no suspicious activity on my account and their alerts about my credit report are helpful reminders.

Pros:

Once I connected all my accounts this is a great way to have a consistent snapshot of my financial standing on a daily basis.

Cons:

Occasionally there are connection issues that seem to occur with the same accounts with little idea on how to resolve fully. Also there are some financial institutions I have accounts with that will not connect.

Missing some nicer features, but the price is right!

Pros:

You can't beat the affordability of the program. Their ad-free version is only $1 a month, and ad-supported is free. It is easy to connect multiple bank accounts, loans, etc. It is easy to add custom transaction types and tags so you can search and sort on whatever criteria you set. Works best for reporting on past transactions.

Cons:

Certain bank accounts seem to get disconnected more often than others, and it can be a pain to reconnect. Not a great tool for financial forecasting or tracking future income and bills. Works better for reporting on expenses that have already occurred.

Mint is the perfect personal finance manager

Pros:

Mint makes managing finances easy and intuitive. Being able to see all of your accounts and budgets in one place makes tracking expenses simple. You can even add custom budget items, recategorize transactions after they have been posted, or split transactions between multiple budgets.

Cons:

It isn't possible to make retroactive changes to budgets after a period has ended. The website is full of many "pop up's" that can be obtrusive.

One of the best money management applications

Pros:

Most of my financial accounts and assets are in my app. Credit, checking, savings, investments, and others are all together. I can see the value of all my accounts at once. I can add bill reminders. I can set spending and saving limits.

Cons:

My main negative remark is that the application disconnects from the financial accounts often and I need to re-sign in a lot. In addition, There are many investment funds that the application does not accept, yet. I hope this will change in the future as I will continue to be a user

Needed budget tool

Pros:

Our agency has utilized this budgeting app as we are a non-profit and funds can be limited. It's critical for our agency to be on top of our spending and where our money is going to. Mint makes it easy for us by laying out our monthly budget and also helping us track purchases.

Cons:

Our agency has not found anything we dislike other than our cards sometimes becoming unlinked and we have to relink them which is simple.

Helpful for budgeting

Pros:

I like that it (obviously) keeps track of spending and shows how much I have available to me.

Cons:

I think the categories of the software could be made to be manipulated a little easier. I don't like that if it's not listed, I make my own list and it has to fall under miscellaneous and doesn't represent well in the pie chart.

Great resource for keeping up with all your financial information

Pros:

Mint is a great tool for creating budgets, managing your spending, managing investments, and tracking and paying bills. You can even keep tabs on your credit score. You can also set reminders about upcoming bills and alerts for any unusual spending activity. The best part is the app is completely free.

Cons:

I'm not sure how I feel about using an app that links all your banking information and credit cards into it. Sure, they say your data is encrypted, but time and time again we have seen all other companies get hacked at some point or another. Also many financial institutions have started implementing these same tools that Mint offers, in which case you wouldn't need to use many of the features that Mint is capable of.

Effortless way to monitor finances

Comments: I use Mint to keep track of my personal finances. It's easy to use and has a lot of great features. It's also completely free! It's a great option for people just getting into personal finance.

Pros:

Mint is a simple yet very thorough app. You can add multiple bank accounts, and credit cards so that you have all your accounts in one place. I really like how Mint categorizes purchases and keeps track of your spending history for you and lays it out in an easy-to-read graph. I also like how educational the app is. Mint offers a lot of information regarding credit cards and investment options specifically for you.

Cons:

Sometimes the app will close out randomly. I've tried uninstalling and reinstalling but it continues to do it occasionally. Other than that minor glitch I haven't experienced any problems with Mint.